If One Project Has a Higher Standard Deviation Than Another

B it has a higher expected value. If one project has a higher standard deviation than another A it has a greater risk.

Standard Deviation Formula Definition Methods Examples

See the answer See the answer done loading.

. It has fewer possible outcomes. It may be riskier but this can only be determined by the coefficient of variation. An investment with a higher standard deviation means it will be more risky and volatile.

On the basis of risk and return an investor may decide that Stock A is the safer choice because Stock Bs additional two percentage. Variance helps to find the distribution of data in a population from a mean. D it may be riskier but this can only be determined by the coefficient of variation.

Standard Deviation SD of project duration is 603 246. It may have a lower risk. Finding out the standard deviation as a measure of risk can show investors the historical volatility of investments.

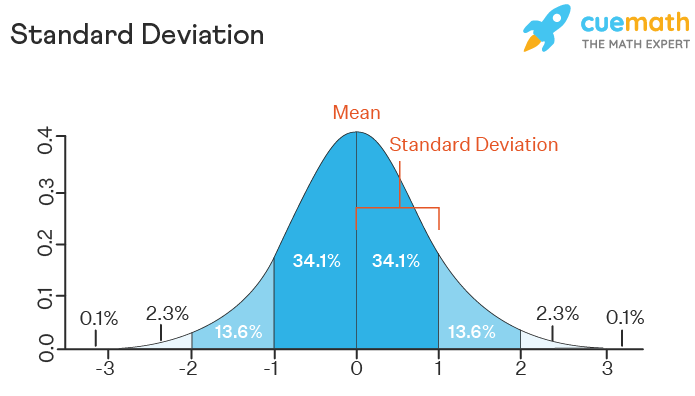

Low standard deviation means data are clustered around the mean and high standard deviation indicates data are more spread out. Up to 256 cash back If one project has a higher standard deviation than another. It has fewer possible outcomes.

If one project has a higher standard deviation than another Group of answer choices. It always has a greater risk. One-tenth of one standard deviation.

This means it gives you a better idea of your datas variability than simpler measures such as the mean absolute deviation MAD. Yes for example a standard normal distribution has a mean of 0 and a standard deviation of 1. It is a measure of volatility and in turn risk.

Therefore the expected return should also be higher. We have seen earlier that t has the probability of 0-5 and this probability is applicable even on a cumulative situation till we reach the end event. Low standard deviation means prices are calm so investments come with low risk.

If one project has a higher standard deviation than another The coefficient of variation V can be defined as the. It may have a lower risk. In charter school studies for instance its unusual to find effects larger than 020-030 sd and most are between zero and 010 sd.

It may be riskier but this can only be determined by the coefficient of variation. A large portfolio of stocks whose betas are greater than 10 will have less market risk than a single stock with a beta 08. Take the Next Step to Invest.

Stock A over the past 20 years had an average return of 10 percent with a standard deviation of 20 percentage points pp and Stock B over the same period had average returns of 12 percent but a higher standard deviation of 30 pp. Expected value multiplied by the standard deviation. Variance is a method to find or obtain the measure between the variables that how are they different from one another whereas standard deviation shows us how the data set or the variables differ from the mean or the average value from the data set.

The standard deviation for the women is higher than the men since 102 55. Having only positive numbers the set 12312 has a mean of 4 and a SD greater than 5. It always has a higher expected value.

A standard deviation close to zero indicates that data points are close to the mean whereas a high or low standard deviation. Variance of the Critical Path 279 279 045 0 603. The higher the standard deviation the more volatile or risky an investment may be.

A large portfolio of randomly selected stocks will have a standard deviation of returns that is greater than the standard deviation of a 1-stock portfolio if that one stock has a beta less than 10. This is significantly higher standard deviation than a market index or almost all stocks. It may be riskier but this can only be determined by the coefficient of variation.

If one project has a higher standard deviation than another it has fewer possible outcomes. Other interventions such as targeted reading improvement programs curriculum and certain early childhood programs have in some cases yielded larger effect sizes. A higher standard deviation tells you that the distribution is not only more spread out but also more unevenly spread out.

If three investment alternatives all have some degree of risk and different expected. The monthly variance will be 5 1-525 0-525 so the standard deviation will be 25. It always has a higher expected value.

C it has more possible outcomes. On the basis of risk and return an investor may decide that Stock A is the safer choice because Stock Bs additional two percentage points of return is. Standard deviation is a measure of how much an investments returns can vary from its average return.

Stock A over the past 20 years had an average return of 10 percent with a standard deviation of 20 percentage points pp and Stock B over the same period had average returns of 12 percent but a higher standard deviation of 30 pp. When prices move wildly standard deviation is high meaning an investment will be risky. Suppose you invest 050 in a coin flip that will pay 1 on heads and 0 on tails a month later.

It may have a lower expected value. Question 3 15 15 points If one project has a higher standard deviation than another it always has a greater risk. It has fewer possible outcomes.

The MAD is similar to standard deviation but easier to calculate. It may be riskier but this can only be determined by the coefficient of variation. Standard deviation divided by the mean expected value.

Difference Between Variance and Standard Deviation. It may have a lower expected value. A standard deviation or σ is a measure of how dispersed the data is in relation to the mean.

This one right over here to get from this top one to this middle one you essentially are taking this data point and making it go further and taking this data point and making it go further and so this one is going to have a higher standard deviation than that one so let me put it just like that. This tells us that there is more variation in weight for the womens results than the mens.

Standard Deviation A Step By Step Guide With Formulas

What Does It Mean By 1 Or 2 Standard Deviations Of The Mean Quora

No comments for "If One Project Has a Higher Standard Deviation Than Another"

Post a Comment